(paid exclusively by the property owners in the Destination District)

over the next 40 years

Once construction begins, the businesses and property owners in the Destination District

will start to contribute to the City’s general fund treasury with new excise and sales tax dollars!

FACT: No current property tax or general fund revenue goes to fund a TIF project!

What is a Tax Increment (Increase)? From the South Dakota Department of Revenue Tax Increment Financing (TIF) Fact Sheet at https://dor.sd.gov/media/d2rjplh3/tax-fact-tax-increment-financing.pdf it states:

A tax increment is the difference between the amount of property tax revenue generated before a TIF district is created and the amount of property tax revenue generated after.

The project costs are paid from the money generated by the tax increment, or the difference between the amount of the property tax revenue before the TIF district is created and the tax revenue generated after.

-

The county, school district, and municipality will continue to receive the same tax revenue

they received prior to the creation of the TIF district. -

After the project costs are paid off, the county, school district, and municipality will begin

sharing the total property tax revenue.

FACT: For no more than 20 years - Only the INCREMENT (INCREASE) in property tax revenue resulting from private capital investment goes to advance a TIF project.

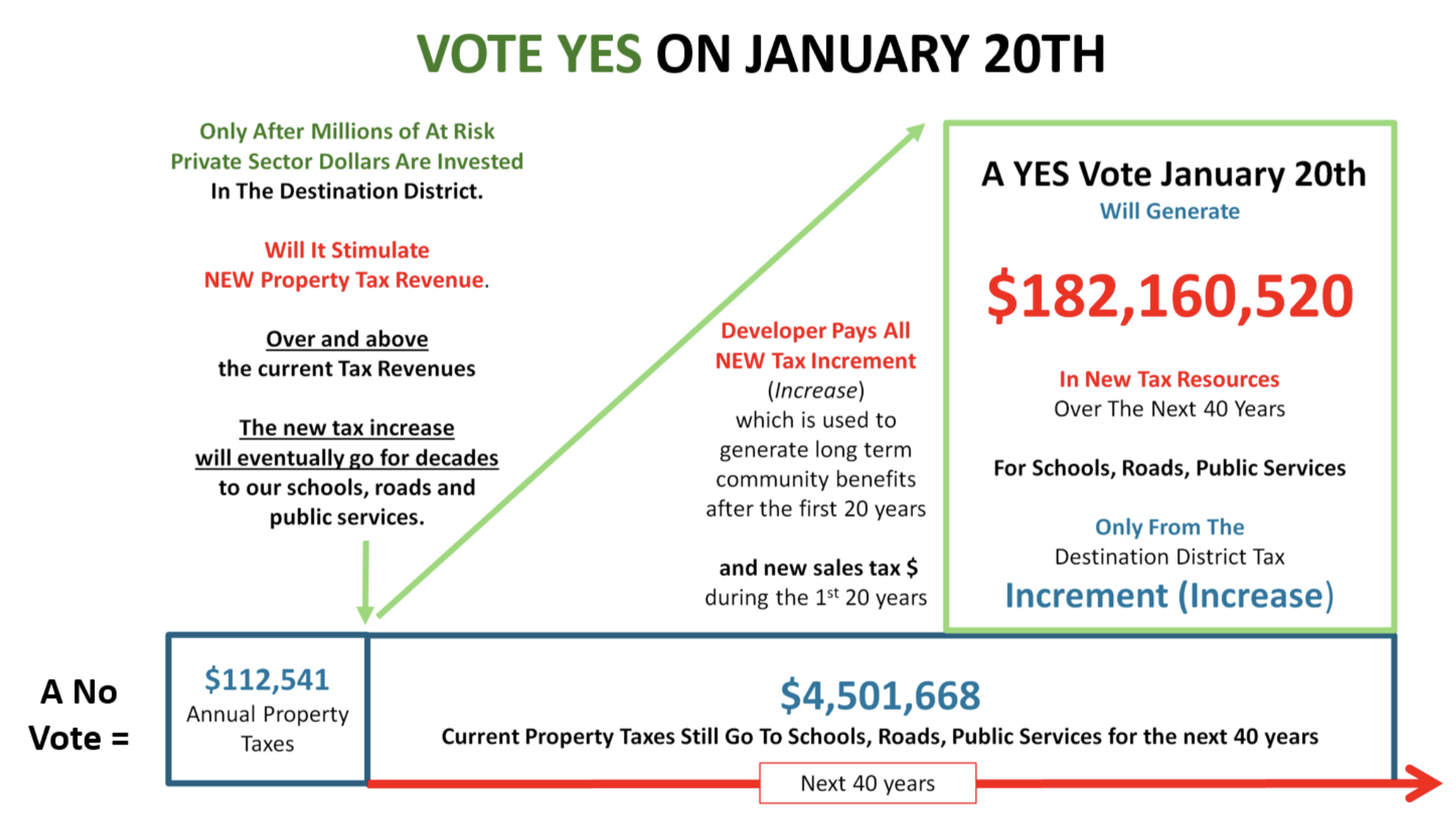

FACT: With no TIF the undeveloped Destination District’s current property tax will generate an estimated total of $4,501,668 over the next 40 years -- to fund schools, roads, and public services.

FACT: The Destination District currently generates $112,542 per year in property tax revenues. The projected annual INCREMENT (INCREASE) in property tax revenues created exclusively by private sector investment in LibertyLand and other elements of the Destination District will create a new property tax INCREASE (INCREMENT) annually of $9,108,026 in year 20 - and beyond!

FACT: Only after private developers put millions of private capital at risk to develop the Destination District and our community's quality of life………. will the District generate, over the next 40 years, an estimated total of $182,160,520 in NEW property tax revenues (paid exclusively by the property owners in the Tax District) to fund our schools, roads, and public services.

FACT: Once construction begins, the Destination District will start to contribute to the City’s general fund treasury with new excise and sales tax dollars!

Do you agree having an increase in NEW property taxes collected

over the next 40 years of an estimated $182,160,520

generated exclusively by private capital investment is a good idea?

If you agree

We need economic development

To keep our share of a growing cost for “our” community services in check!

We need economic development to match the unstoppable increase in decades to come, to pay for the ever increasing cost of education, roads, and all the other public services we depend on. Let’s try to explain that in the following hypothetical illustration.

Let’s say a hypothetical communities’ expenses for public services, etc. are $100,000,000 per year and there are 100,000 families in that community, each making an average income per year of $100,000. Under those hypotheticals, each family’s annual tax burden share, to maintain the costs of “their” communities’ public services, schools, and road expense could be estimated to be $1000.

Let’s say that same hypothetical communities’ expenses go up by 2% a year for the next 20 years; but their population stays the same; as well as each family’s average income. In year 20 the communities’ schools, roads, and public service costs would now be “hypothetically” around $148,000,000 with each of the 100,000 family’s hypothetical tax burden share in that cost, is now $1,480. Which is now a higher % of that family’s income.

The way we keep our share of a growing cost for “our” community services in check; is to grow the economy; or we have to grow the number of its citizens paying taxes. The simple math requires that you grow the economy (which generates more sales tax); grow the number of businesses generating sales tax and property taxes; or increase the number of taxpayers or the percentage of taxes each of us have to pay.

It makes even more sense to prioritize a taxation method where a lot of the growth in sales tax revenues comes from visitors. Increased “outsider” visitation increases sales tax revenues and then they go home!

Attracting visitors in the Black Hills has contributed for generations to keeping our share of the tax’s

we locals pay, as low as possible in covering the ever increasing costs of schools and community services. And by the way, U.S. News and World report states that South Dakota is rated as the #1

lowest, regarding a states per capita tax burden.

https://www.usnews.com/news/best-states/rankings/economy/business-environment/tax-burden

Some in our community (which is of course their right) do not want more people to move here. If that is your position, the facts are that we need to grow the economy and tax base of our community so that each of us do not have to pay, in decades to come, a higher percentage of our family’s income to cover the ever increasing costs of public services we “all” need.

FACT: It’s all in the math. And the wise decision is to plant trees now, so we can harvest the fruit they generate in the future, for generations to come.

Imagine if those who envisioned Mt. Rushmore did not take the risk and make the investment in the time and the costs necessary to carve that mountain? Without that vision and investment where would the Black Hills, the State of South Dakota, and Rapid City be now? I think we can all agree it would NOT be the thriving community now we all know, love, and want to protect. And “we” all inherited from those visionaries.

The locally controlled development team behind LibertyLand, seek that same generational benefit for theirs and our community - and is the core motivation to taking their financial risks associated with proposing LibertyLand as the patriot heartbeat of the Destination District, here at the foot of the Shrine of Democracy - and grow ours and their community’s quality of life, generate new tax revenues for schools and public services, as well as provide jobs and careers for Rapid City families for generations to come.

For more information of public presentation regarding the FACTS set out herein, contact

info@VoteYesJan20.com